Home – Case Studies – Developing an Industry Investment Fund to Scale Transformative Packaging Solutions and Achieve Scope 3 Targets

The situation

The cosmetics industry produces 166 billion packaging units annually, contributing significantly to its environmental footprint. Packaging production remains heavily reliant on virgin plastics and carbon-intensive manufacturing processes, such as traditional aluminium and glass production. Recycling infrastructure and availability of high-quality recyclate remain insufficient to meet industry needs, while alternatives like refillable systems lack the shared infrastructure required for widespread adoption.

The cosmetics industry faces systemic obstacles in its transition to sustainable packaging. While many industry leaders have set ambitious sustainability targets, individual efforts fail to achieve the scale, cost-efficiency, and systemic change required. Suppliers and recyclers often lack the margins, capital, and agility needed to scale low-carbon technologies such as advanced material innovation or green hydrogen.

Without a unified approach, fragmented efforts will continue to hinder progress, jeopardising the industry’s ability to meet its 2030 goals.

Our solution

Anthesis is forming a collective of cosmetics players that will jointly invest (~€100m) in key technologies (ventures) while generating strategic, financial and impact returns. Anthesis will proactively support its clients with the adoption of key solutions by getting the corporates venture-ready and the ventures corporate-ready. Anthesis has partnered with a venture capital firm with a strong 20+ year investment track record to act as the fund manager.

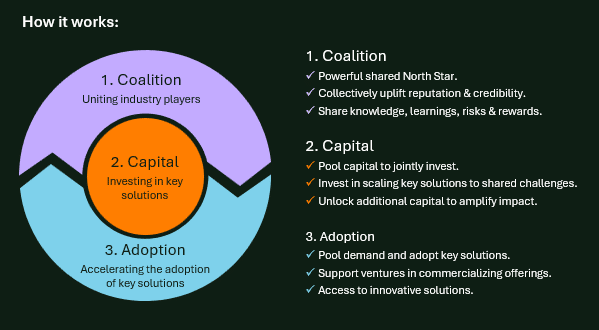

The cosmetics pivot fund is built on 3 key strategies of Coalition – uniting industry players, Capital – Investing in key solutions, and Adoption – accelerating the adoption of key solutions.

Impacts of the project

- Strategic returns: Helps corporates future-proof their business by building supply chain resilience, leading with innovation, and demonstrating brand leadership.

- Financial returns: Corporates will receive a positive return on their investment while potentially achieving operational cost savings and unlocking additional capital.

- Impact returns: Accelerates corporates to close their scope 3 gap to goals.

Explore our Innovation & Capital solutions

Discover how Anthesis can support your sustainability ambitions.

Get in touch

We’d love to hear from you

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.